Understanding Business Entities: Form It Right, Tax It Smart, Retire on Purpose™

Business strategies for solopreneurs

Common Business Structures

Several terms are commonly used to refer to what business entity to deploy when operating a business.

Of course, there are sole proprietorships, partnerships, corporations, and, more recently, limited liability companies or LLCs.

State Filing Requirements

All states, usually through their Secretary of State’s office, have various requirements regarding whether or not a business entity needs state approval to operate.

These rules vary from state to state; however, generally:

Sole Proprietorships are typically exempt from any filing requirements

Corporations and LLCs are commonly required to file

Partnerships fall into a middle ground:

General partnerships are usually exempt

Limited partnerships may or may not be exempt

Limited Liability partnerships are generally required to file

Each state promulgates different filing requirements, start-up and annual fees, and annual reports through its Secretary of State office.

Understanding DBAs

Additionally, all states have a concept known as DBA or “Doing Business As.” Some states refer to this as Fictitious Name, Trade Name, Assumed Name, and even Fictitious Business Name.

Any business form can utilize this concept, and this filing declares a name under which the business will be conducted. Generally, the Secretary of State confirms that the requested name does not conflict with any other business name.

Thus, for example, an individual sole proprietor can file a DBA identifying as Joseph A. Smith, DBA, or Doing Business As “Smith Electric.”

Often, the entity is registered in the individual’s birth name with DBA or DBAs identified as their operating businesses. This concept allows you to have more than one DBA assigned to a specific company, which provides branding flexibility, allows multiple companies under the same umbrella entity, and provides privacy for the owner.

What about the S Corporation?

Many are confused by this. The S corporation is not a state-authorized entity but rather a tax election available to both C Corporations and LLCs.

A state’s right to authorize a business form or entity is separate from the taxing authorities’ (Federal and State) rights regarding how that entity will be taxed.

When someone says they are an S Corporation, what they really mean is that they are either a C Corporation or an LLC that has elected to be taxed as a Subchapter S Corporation under the Internal Revenue Code.

S Corporation Eligibility

C Corporations can elect to be taxed as S corporations if they meet the S corporation limitations, generally:

100 or fewer eligible shareholders (U.S. citizens/residents, certain trusts, and organizations)

Maintain only one class of stock (except voting and non-voting stocks)

Avoid certain restricted business types (Insurance companies, certain financial institutions, and DISCs)

LLC Tax Classifications

By default, LLCs are classified according to their membership structure for federal tax purposes:

Single-member LLCs are automatically treated as “disregarded entities,” which means they’re taxed as sole proprietorships by default. The LLC’s income and expenses are reported on the Schedule C of the owner’s tax return (Form 1040).

Multi-member LLCs are automatically treated as partnerships by default. The LLC files an informational tax return (Form 1065), and profits/losses pass through to the members’ tax returns via Schedule K-1.

In addition to their default position, both single-member and multi-member LLCs can elect to be taxed as either a:

C Corporation (by filing Form 8832), or

S Corporations (by filing Form 2553, after first electing C Corporation status if necessary)

This flexibility in tax treatment is one of the significant advantages of the LLC structure. It allows business owners to choose the tax classification that best suits their financial and business situation while retaining their current entity structure.

LLC vs. C Corp: Liability Protection

Both LLC and C Corp structures shield owners from automatic liability for business actions. However, this protection isn’t absolute and can be pierced under certain circumstances, such as:

Personal guarantees on loans

Fraud or illegal activities

Commingling personal and business assets

Failing to maintain proper corporate formalities, such as minutes and state filings

If managed correctly, this liability protection is a distinct advantage.

C and S Corp Entity Differences

C Corporations are taxed on net income at the corporate level, currently 21%. Additionally, dividends are not deductible, thus resulting in a double tax.

S Corporations are treated as pass-through entities, and the net income flows to the individual shareholders or members to be reported on their tax returns.

Ownership Limitations: C Corporations can have unlimited shareholders. Thus, listed companies are generally C Corporations. The Sub S election limits owners to 100 and also limits the type of owners and businesses.

To conclude, both C Corporations and LLCs with an S Corp election are designed for specific purposes. Generally, solopreneurs are better served by an LLC to obtain liability protection and a Sub S election to receive certain tax benefits.

The S Corp Tax Savings Difference

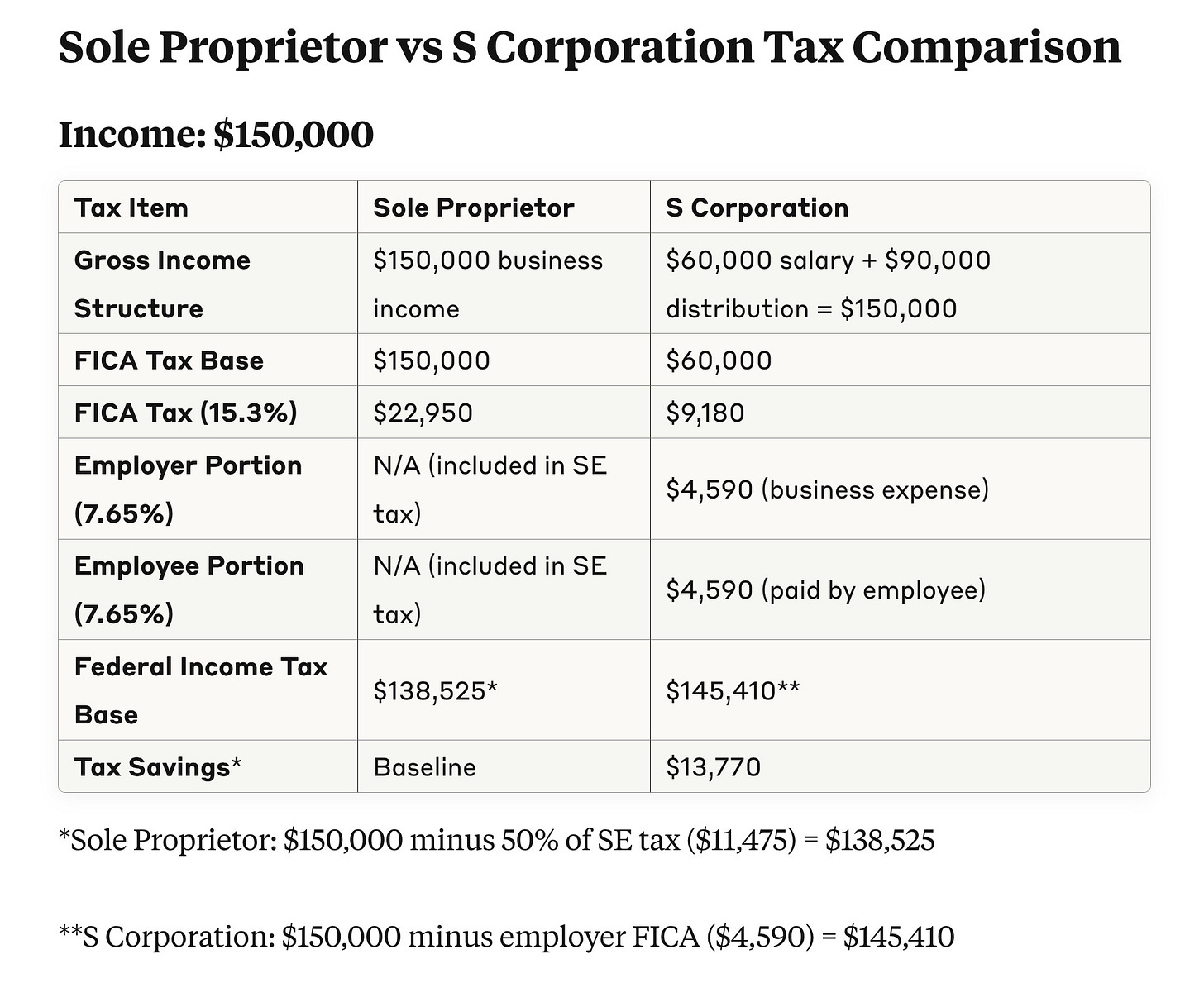

In its simplest form, S Corps provides tax savings by splitting net income into ordinary income, or a reasonable salary, which pays FICA (15.3%), and dividend distributions, which, as passive income, do not pay FICA.

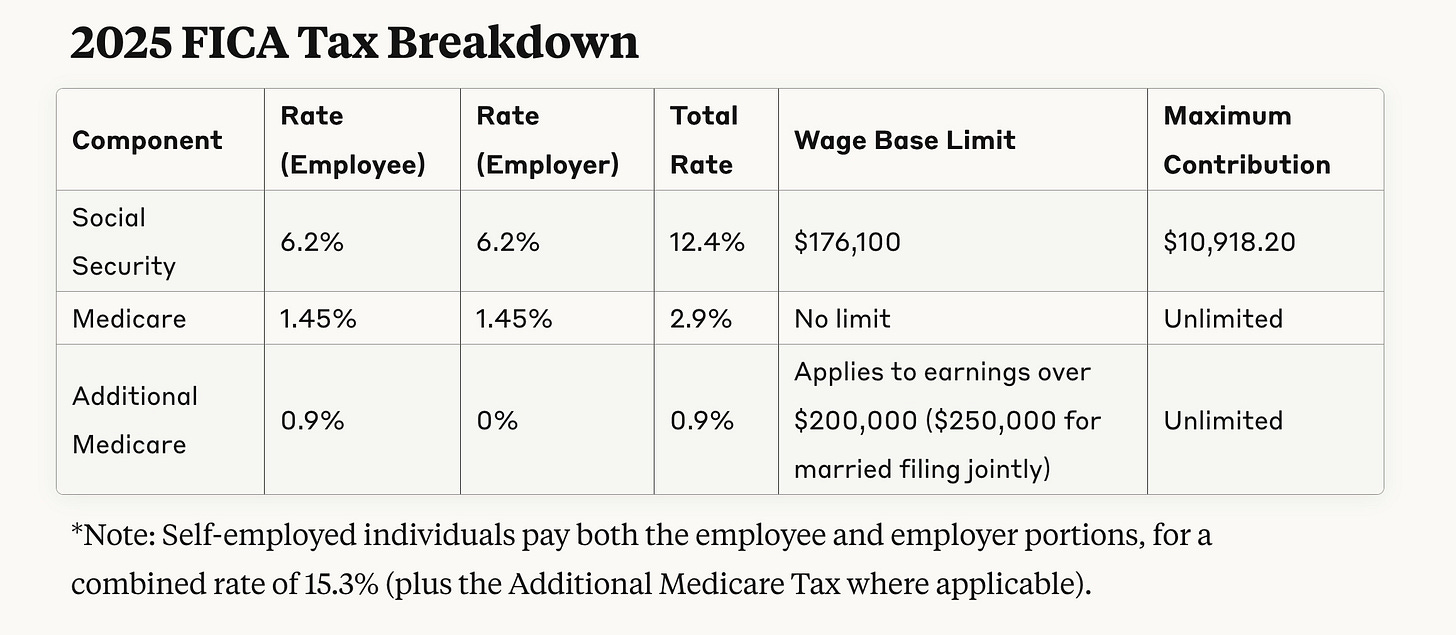

The following table details the FICA amounts as of 2025.

The following table details the tax savings of using an S Corp vs. a Sole proprietorship:

Wealth Creation through Tax Savings

The $13,770 annual tax savings isn’t merely a reduction in your tax bill—it’s potent capital that can fundamentally transform your financial future. By structuring your business as an S Corporation, you’re not just sending less money to government programs; you’re redirecting those funds into your retirement investment vehicles where they can compound and grow substantially over time.

Consider this: investing $13,770 annually at a modest 7% return over 20 years creates a retirement nest egg exceeding $570,000. That’s over half a million dollars of wealth creation from a single tax strategy.

Without this approach, those same dollars disappear into the Social Security and Medicare systems, where you have limited control over any eventual benefits.

The choice is stark: build personal wealth or fund government programs. The S Corporation structure legally allows you to choose the former.

Important Caveats

There are several caveats you need to be aware of:

Professional Guidance Required

This is not a DIY project. My purpose in writing this is to make you aware of some significant planning opportunities. However, you need to seek professional help. Unfortunately, this arena has several scams because the potential benefits are so fantastic, and many easily fall prey when they become aware of them.

Special Considerations

The LLC has specific uses for real estate (and other property) ownership, as a holding company for multiple professionals who each set up a separate entity and elect S-Corporate status, and as an operating business entity for those who choose the S-Corporate election. However, there are no “one-size-fits-all” solutions.

State Tax Variations

Some states are better than others regarding these entities and the S election. An LLC creation in a favored state is often sold to unsuspecting businesses. However, if you are not doing business in that state, you won’t receive any additional benefits and will still have to file and pay taxes in the state where you’re doing business.

Additionally, some states, like DC, New Hampshire, Tennessee, and Louisiana, disregard entirely the S-Corporation and tax businesses as C Corporations. Others, like California, Illinois, and Michigan, have a level franchise tax they charge S-Corporations. Finally, still others, like Massachusetts, tax S corporations on their profits only when they exceed certain thresholds. The remaining states essentially follow the IRS.

Finding the Right Solution

There are many situations where the LLC with an S Corp election makes perfect sense, but each person’s situation is different and, therefore, can only be determined with professional help. Unfortunately, if your tax advisor has not brought this subject up before, you must consider whether you have the right advisor.

This only scratches the surface, and several other business entities, tax, estate planning, and retirement investment considerations remain to be discovered and implemented.

Next Steps

In the interim, I make two recommendations for you to move forward in your business, tax, legal, retirement, and estate planning efforts. Both companies are highly recommended, and Northwest is an affiliate link with a $39 special price to set up your business.

One final comment

It may or may not be apparent, but the taxing structure in the U.S. significantly favors small businesses. Indeed, efforts have and will continue to be made for employees, but the opportunities rest with those willing to start their own companies, even if it’s nothing more than a side hustle. This article only touches on a small portion of the opportunities that await those willing to venture out on their own as solopreneurs.

#EntityStructure, #TaxStrategy, #PurposefulRetirement

This is the first in a series of tax and business planning posts for solopreneurs. These articles will help with everyday business planning and contribute to retirement and estate planning in a way few realize.